CORRECTION NOTICE: Reissued with corrections to column headings in attached tables

TORONTO — Jun 8, 2023 — Trigon Metals Inc. (TSX-V: TM; OTCQB: PNTZF) (“Trigon” or the “Company”) announces drill results from the East 600 planned open pit, at the Kombat mine in Namibia (the “Project”). These holes were drilled to confirm known historical mineral resources drilled previously by the prior owner from the underground. These results are new to the East 600 area and represent some of the longest mineralized intercepts drilled from surface. East 600, also referred to as the ore capping zone, is located 400m east of the main pit and has been incorporated into our resource plan and mine plan.

Highlights of the Drill Results

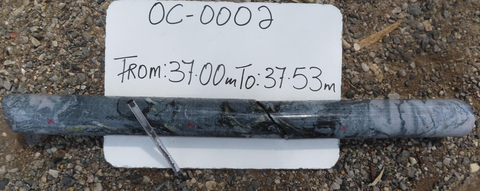

Hole 2

Intersected 4.34m, 1.56% Cu, from 37m

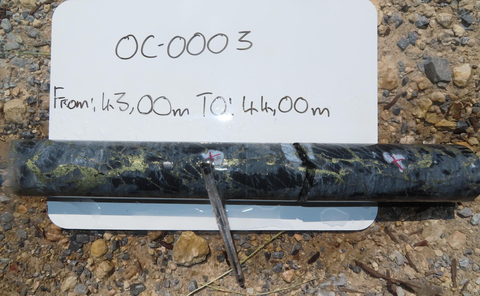

Hole 3

Intersected 10m, 1.14% Cu, from 40m

Hole 4

Intersected 76m at 1.48%Cu, 8.9g/t Ag from 22m, including:

– 13m, 1.46% Cu, 5.7g/t Ag, from 3m, and

– 21m, 3.54%Cu, 17.9g/t Ag from 49m, and

– 11m, 1.39%Cu, 5.61g/t Ag from 87m.

Mining Update

Trigon has now completed one full month of mining at Kombat, and the ramp-up to full mining production is going well. The goal for May was 120,000t of mined rock, and 124,000t were mined. May was strictly waste tonnes, but high-grade mineralization has been exposed in several areas of the pit. The first ore tonnes are scheduled to be mined towards the end of June.

Blasts have occurred on schedule once a week, this schedule will be maintained until the mill starts at the end of July, whereupon blasts are scheduled twice a week. We anticipate mining rates will average 8,000 tpd when the mine is in full operation. However, in start-up mode mining rates have reached up to 10,000t on days when the team has pushed to test capacity.

Jed Richardson, Trigon’s President and CEO, commented, “Current drilling at East 600 is increasing our confidence of adding more high-grade ore and reducing our overall strip ratio. We will continue to test areas around the planned open pits; East 400, East 600, and East 900 as potential sources for adding near surface high-grade ore. In addition, drilling is planned for the Otavi area, 12km west of the Kombat mining permit to test the limbs of our 35km of mineralized strike-length corridor.”

The assays have been prepared and classified by Trigon Mining (Namibia)(Pty) Ltd in accordance with the reporting guidelines as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by the Canadian Securities Administrators.

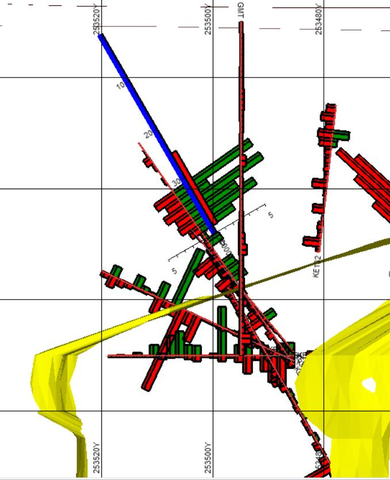

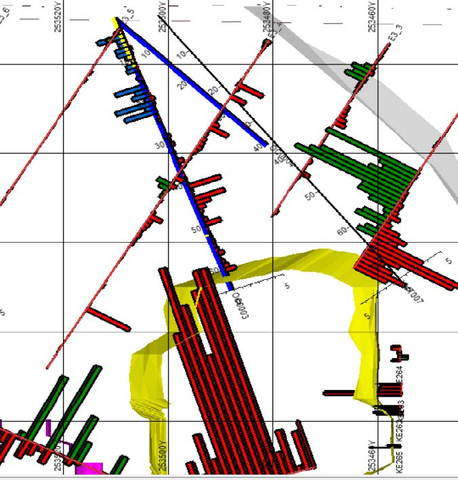

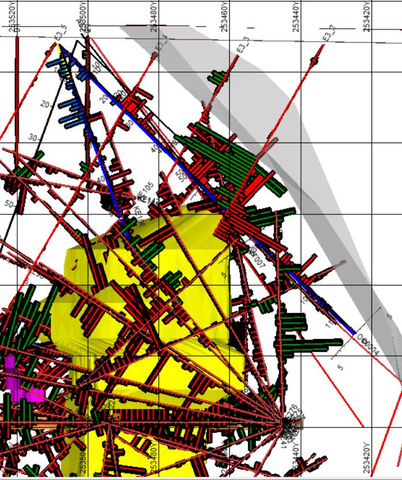

Figure 1: Map of the Kavango Program Area Showing the Location of Holes 2, 3 and 4 in the Kavango East Area The holes 2, 3 and 4 are located the heart of the Kavango Trend in the East 600 (Ore Cap) Pit.

Figure 2: Cross Section – Hole 2 Figure 2 shows the modelling done before the drilling of OC0002(Dip-60). It shows a copper intersection between 25-41.34m with 1.10% Cu between 35-41.34m.

Figure 3: Drill Core — Hole 2 The core pictured shows visible sulfide mineralization.

Figure 4: Cross Section – Hole 3 Figure 4 shows the modelling done before the drilling of OC0003(Dip-69.9). It shows a copper intersection between 3-65.15m with 1.14% Cu over 10m between 40-50m.

Figure 5: Drill Core from Hole 3 The core pictured in Figure 5 shows the clearly visible sulfide mineralization.

Figure 6: Cross section — Hole 4 Figure 6 shows the modelling done before the drilling of OC0004(Dip-44.3). This shows a copper intersection between 4-107, with traces of copper oxide between 4-7m, with copper sulfide mainly between 22-107m. There are three ore pockets, 1.26% Cu over 15m between 22-37m, 3.13%Cu over 24m between 47-71m and 1.29% Cu over 12m between 86-98m.

Figure 7: Drill Core from Hole 4 The core pictured in Figure 7, again shows shiny golden-coloured chalcopyrite mineralization (copper mineral) throughout the drill core.

Table of Drilling Highlights

| Hole | From (m) | To (m) | Length (m) | Cu% | Pb% | Zn% | Ag (ppm) |

| OC0002 | 37.00 | 38.00 | 1.00 | 2.81 | 0.36 | 0.01 | 2.50 |

| OC0002 | 38.00 | 39.00 | 1.00 | 2.75 | 0.44 | 0.01 | 2.50 |

| OC0002 | 39.00 | 40.00 | 1.00 | 2.76 | 2.9 | 0.01 | 9.32 |

| OC0002 | 40.00 | 41.34 | 1.34 | 2.71 | 2.3 | 0.01 | 6.73 |

| OC0003 | 40.00 | 41.00 | 1.00 | 2.81 | 3.21 | 0.01 | 9.37 |

| OC0003 | 41.00 | 42.00 | 1.00 | 2.80 | 0.24 | 0.01 | 2.50 |

| OC0003 | 42.00 | 43.00 | 1.00 | 2.77 | 0.15 | 0.01 | 2.50 |

| OC0003 | 43.00 | 44.00 | 1.00 | 2.84 | 3.07 | 0.01 | 2.50 |

| OC0003 | 44.00 | 45.00 | 1.00 | 2.83 | 1.45 | 0.01 | 2.50 |

| OC0003 | 45.00 | 46.00 | 1.00 | 2.81 | 0.73 | 0.01 | 2.50 |

| OC0003 | 46.00 | 47.00 | 1.00 | 2.80 | 0.34 | 0.01 | 2.50 |

| OC0003 | 47.00 | 48.00 | 1.00 | 2.80 | 0.16 | 0.01 | 2.50 |

| OC0003 | 48.00 | 49.00 | 1.00 | 2.84 | 0.42 | 0.01 | 2.50 |

| OC0003 | 49.00 | 50.00 | 1.00 | 2.84 | 1.58 | 0.01 | 12.62 |

| OC0004 | 22.00 | 23.00 | 1.00 | 2.85 | 0.81 | 0.92 | 2.50 |

| OC0004 | 23.00 | 24.00 | 1.00 | 2.79 | 0.25 | 0.005 | 2.50 |

| OC0004 | 24.00 | 25.00 | 1.00 | 2.87 | 2.97 | 0.01 | 12.47 |

| OC0004 | 25.00 | 26.00 | 1.00 | 2.82 | 2.26 | 0.005 | 2.50 |

| OC0004 | 26.00 | 28.00 | 2.00 | 2.80 | 2.47 | 0.005 | 2.50 |

| OC0004 | 28.00 | 29.00 | 1.00 | 2.85 | 2.9 | 0.02 | 18.05 |

| OC0004 | 29.00 | 30.00 | 1.00 | 2.77 | 0.57 | 0.005 | 5.68 |

| OC0004 | 30.00 | 31.00 | 1.00 | 2.78 | 0.2 | 0.005 | 2.50 |

| OC0004 | 31.00 | 32.00 | 1.00 | 2.78 | 0.65 | 0.005 | 2.50 |

| OC0004 | 32.00 | 33.00 | 1.00 | 2.79 | 2.2 | 0.005 | 15.67 |

| OC0004 | 33.00 | 34.00 | 1.00 | 2.75 | 0.64 | 0.005 | 2.50 |

| OC0004 | 34.00 | 35.00 | 1.00 | 2.74 | 0.64 | 0.005 | 2.50 |

| OC0004 | 35.00 | 37.00 | 2.00 | 2.81 | 0.53 | 0.005 | 2.50 |

| OC0004 | 37.00 | 39.00 | 2.00 | 2.77 | 0.03 | 0.005 | 2.50 |

| OC0004 | 39.00 | 41.00 | 2.00 | 2.76 | 0.03 | 0.005 | 2.50 |

| OC0004 | 41.00 | 42.00 | 1.00 | 2.81 | 0.005 | 0.005 | 2.50 |

| OC0004 | 42.00 | 43.00 | 1.00 | 2.79 | 0.06 | 0.005 | 2.50 |

| OC0004 | 43.00 | 44.00 | 1.00 | 2.76 | 0.28 | 0.005 | 2.50 |

| OC0004 | 44.00 | 47.00 | 3.00 | 2.78 | 0.005 | 0.005 | 2.50 |

| OC0004 | 47.00 | 49.00 | 2.00 | 2.77 | 0.17 | 0.005 | 2.50 |

| OC0004 | 49.00 | 51.00 | 2.00 | 2.70 | 0.65 | 0.005 | 2.50 |

| OC0004 | 51.00 | 52.00 | 1.00 | 2.74 | 2.65 | 0.005 | 7.44 |

| OC0004 | 52.00 | 53.00 | 1.00 | 2.58 | 2.08 | 0.005 | 6.40 |

| OC0004 | 53.00 | 54.00 | 1.00 | 2.86 | 8.33 | 0.02 | 31.23 |

| OC0004 | 54.00 | 55.00 | 1.00 | 2.81 | 5.44 | 0.005 | 19.03 |

| OC0004 | 55.00 | 57.00 | 2.00 | 2.70 | 1.08 | 0.005 | 2.50 |

| OC0004 | 57.00 | 59.00 | 2.00 | 2.77 | 0.67 | 0.005 | 2.50 |

| OC0004 | 59.00 | 61.00 | 2.00 | 2.69 | 0.3 | 0.005 | 2.50 |

| OC0004 | 61.00 | 62.00 | 1.00 | 2.93 | 0.6 | 0.005 | 2.50 |

| OC0004 | 62.00 | 63.00 | 1.00 | 2.67 | 12.01 | 0.005 | 74.67 |

| OC0004 | 63.00 | 65.00 | 2.00 | 2.94 | 6.75 | 0.005 | 41.50 |

| OC0004 | 65.00 | 66.00 | 1.00 | 2.68 | 1.11 | 0.005 | 6.17 |

| OC0004 | 66.00 | 68.00 | 2.00 | 2.88 | 6.78 | 0.01 | 46.80 |

| OC0004 | 68.00 | 69.00 | 1.00 | 2.94 | 8.41 | 0.01 | 29.72 |

| OC0004 | 69.00 | 70.00 | 1.00 | 2.72 | 1.34 | 0.01 | 2.50 |

| OC0004 | 70.00 | 71.00 | 1.00 | 2.69 | 0.39 | 0.09 | 2.50 |

| OC0004 | 71.00 | 72.00 | 1.00 | 2.81 | 0.04 | 1.56 | 2.50 |

| OC0004 | 72.00 | 73.00 | 1.00 | 2.75 | 0.02 | 0.11 | 2.50 |

| OC0004 | 73.00 | 75.00 | 2.00 | 2.74 | 0.005 | 0.005 | 2.50 |

| OC0004 | 75.00 | 77.00 | 2.00 | 2.80 | 0.005 | 0.08 | 2.50 |

| OC0004 | 77.00 | 78.00 | 1.00 | 3.40 | 0.15 | 0.2 | 74.48 |

| OC0004 | 78.00 | 79.00 | 1.00 | 2.97 | 0.11 | 0.07 | 23.00 |

| OC0004 | 79.00 | 80.00 | 1.00 | 2.80 | 0.27 | 0.08 | 2.50 |

| OC0004 | 80.00 | 81.00 | 1.00 | 2.74 | 0.07 | 0.72 | 2.50 |

| OC0004 | 81.00 | 82.00 | 1.00 | 2.79 | 0.18 | 0.38 | 2.50 |

| OC0004 | 82.00 | 83.00 | 1.00 | 2.75 | 0.15 | 0.39 | 2.50 |

| OC0004 | 83.00 | 84.00 | 1.00 | 2.76 | 0.02 | 0.23 | 2.50 |

| OC0004 | 84.00 | 85.00 | 1.00 | 2.73 | 0.04 | 0.5 | 2.50 |

| OC0004 | 85.00 | 86.00 | 1.00 | 2.78 | 0.05 | 0.05 | 2.50 |

| OC0004 | 86.00 | 87.00 | 1.00 | 2.86 | 0.12 | 0.005 | 2.50 |

| OC0004 | 87.00 | 88.00 | 1.00 | 2.85 | 1.48 | 0.02 | 2.50 |

| OC0004 | 88.00 | 89.00 | 1.00 | 2.80 | 1.63 | 0.005 | 2.50 |

| OC0004 | 89.00 | 90.00 | 1.00 | 2.80 | 0.87 | 0.005 | 2.50 |

| OC0004 | 90.00 | 91.00 | 1.00 | 2.78 | 1.00 | 0.005 | 2.50 |

| OC0004 | 91.00 | 92.00 | 1.00 | 2.77 | 1.07 | 0.01 | 2.50 |

| OC0004 | 92.00 | 93.00 | 1.00 | 2.79 | 1.03 | 0.005 | 2.50 |

| OC0004 | 93.00 | 94.00 | 1.00 | 2.91 | 4.04 | 0.01 | 29.71 |

Quality Assurance & Quality Control (QA/QC):

All sample assay results have been monitored through the Company’s quality assurance/quality control (QA / QC) program following E2941 − 21 Standard Practices for Extraction of Elements from Ores and Related Metallurgical Materials by 4 acid Digestion with ICPOES finish. Drill core was sent to an independent laboratory, African Laboratory Specialists Namibia (“ALS”), for analysis. ALS is an independent laboratory, located in Kombat, Namibia. Core samples were prepared using the ASTM procedures. Sample size: 3 kg, crushed split to 250g weighed sample (+/- 0.5000g).

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Renmark Financial to Host Virtual Non-Deal Roadshows Next Month

Trigon will be participating in a live Virtual Non-Deal Roadshow session on Wednesday, June 14, 2023. Trigon welcomes stakeholders, investors, and other individual followers to register and attend this live event.

Jed Richardson, President and Chief Executive Officer, and Aidan Sullivan, Vice-President, Investor Relations will walk viewers through the latest investor presentation followed by a live Q&A. Investors interested in participating in this event will need to register using the link below. As a reminder, registration for the live event may be limited but access to the replay after the event will be on the Trigon website.

REGISTER HERE:

Wednesday, June 14, 2023 at 2:00 PM ET:

https://www.renmarkfinancial.com/events/renmark-virtual-non-deal-roadshow-tsx-v-tm-otcqb-pntzf-2023-06-14-120000

Please access this link using the latest version of Google Chrome to ensure smooth connectivity.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently, the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Project, the mineralization of the Project, the Company’s exploration plans and results thereof, the prospectivity of the Project, the economic viability of the Project, the Company’s ability to restart operations and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Contacts

For further information, contact:

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com