TORONTO – Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) provides the following operational update and review of mining performance, ore processing and copper concentrate shipments from its Kombat Mine in Namibia.

The restart of the Kombat Mine has been a tremendous achievement for Trigon and its shareholders, as well as the Kombat community and country of Namibia. The mine employs 220 Namibians both directly and as contractors. An additional 80 women are employed on a part-time rotational basis as part of the Company’s community garden agricultural development project.

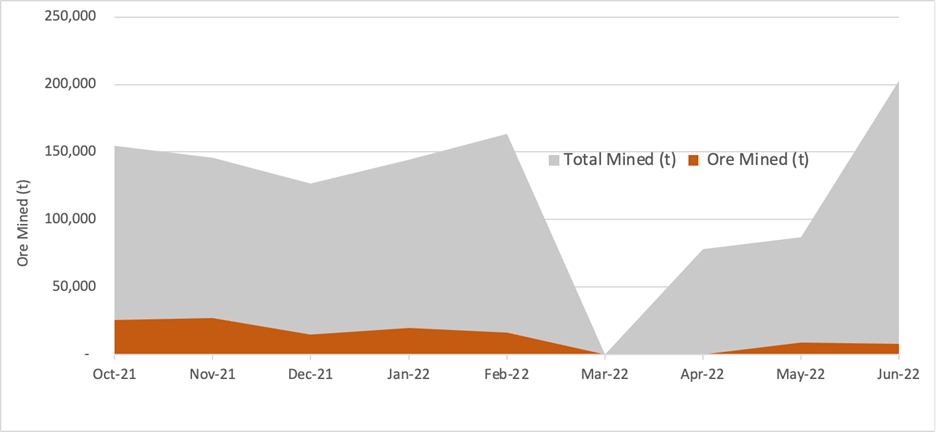

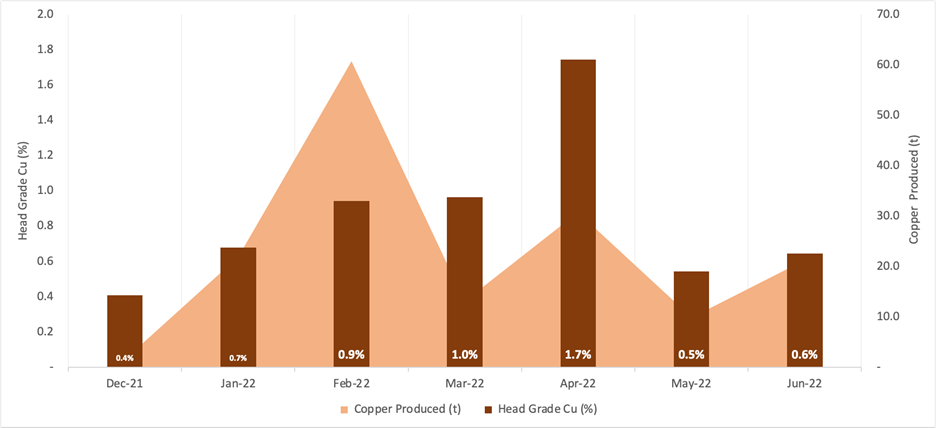

To date 1,103,312 tonnes of material have been mined including pre-stripping, 120,775 tonnes of ore have been mined at an average grade of 0.92% copper and 6.9 g/t silver.34,762 tonnes of ore grading 0.85% copper and 10.97 g/t silver have been fed into the mill and processed, producing 861.4 tonnes of concentrate grading 19.75% copper and 271.3 g/t silver. To date, 548 tonnes of concentrate have been shipped and revenue received.

Jed Richardson, President and CEO, commented, “The Kombat Mine is advancing towards achieving commercial production. During this process, a number of challenges arose that were addressed successfully. A new loan facility was arranged, the processing plant capacity was increased to 350 tonnes per day and a second open pit, which will soon be yielding higher grade sulphide ore, was developed.”

Working Capital Needs Addressed

The working capital issues that had previously hampered production were overcome with a refinancing and a US$2.5M advance on our planned silver stream from the Company’s largest shareholder, Eric Sprott. The mine is currently meeting its financial obligations from the sale of concentrates. Trigon is also in advanced discussions on the official sale of silver revenues in a streaming agreement that will bring in additional capital necessary to advance underground development. Kombat, through its 45-year operating history, has been an underground mine, and the planned return to underground mining will increase copper and silver grades and lower operating costs, boosting production and profitability.

Mill Flexibility

Through the start-up, the ore has been highly oxidized and the feed grade has been highly variable, resulting in the production of some low-quality concentrates. Through March and April, the processing plant team completed the final upgrade of the mill. The process included the installation of reagent dosing pumps to improve the accuracy of dosing as the reagent dosing had previously been erratic. Over this period, the plant also underwent a variety of upgrades with the aim of increasing plant capacity and reliability. Some of the key tasks completed include:

- Changing the secondary crusher 2 from obsolete 2.4kV spares to 525V supply to ensure reliability.

- Cleaning build-up from fines silos to increase available storage capacity

- Improving ball mills feed chute distribution to ensure a stable flow

- Changing the design of the bagging plant to ensure material of the correct consistency is bagged at the required rate to meet daily requirements

A key component of the upgrade was the installation of additional flotation cells, anticipated benefits of which include:

- Increased flotation retention time.

- Ability to float oxides and sulphides separately.

- Ability to produce Cu and Pb concentrates.

At present, the processing plant has the capacity to produce in excess of 350 tonnes per week. Production is constrained by mine production.

Mining Throughput

High oxidation and variability of the ore in the open pit mining blocks has slowed mining output. In February, mining moved to mining smaller benches and requiring a higher volume of samples including blast hole sampling to get control of grade. This was effective in April, with head grades averaging 1.7% well above the 1.0% target, but it slowed down mining, falling below the mill capacity. The primary problem was the cycle time for confirmation sampling. In June, a mobile XRF sampling team was created and deployed to the mining pit giving the mining team instant feedback and allowing mining speeds to increase.

In addition, mining has begun in the Kavango pit a parallel structure to the Central pit where all of the ore has been sourced to date. The nature of the mineralization in the Kavango pit is more massive, larger higher grade mining blocks, that are expected to allow for higher mining output compared to stringy highly variable vein swarms mined in the Central pit. Currently, highly oxidized ore is being mined at Kavango as the team benches down to the sulphide ore. The mill should start receiving higher grade, high recovery ore from Kavango in the next two weeks.

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly-traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently, the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

This news release may contain forward-looking statements. These statements include statements regarding the commercial production, the proposed silver streaming agreement, the Company’s strategies and the Company’s abilities to execute such strategies, the Company’s expectations for the Kombat project and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts

For further information, contact:

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com