Atrium Research has published an initiation report on Trigon Metals Inc.

Trigon is cashed up (~$C34M) to initiate and ramp production 5x from FY24 to FY27 at its 80% owned Kombat Mine in Namibia.

Click the download button to view the full report.

TSX-V: TM | FRA: TZU2 | OTCQB: PNTZF

by trigonmetals

Atrium Research has published an initiation report on Trigon Metals Inc.

Trigon is cashed up (~$C34M) to initiate and ramp production 5x from FY24 to FY27 at its 80% owned Kombat Mine in Namibia.

Click the download button to view the full report.

by trigonmetals

TORONTO — Feb 22, 2023 — Trigon Metals Inc. (TSX-V: TM; OTCQB: PNTZF) (“Trigon” or the “Company”) announces additional results from the drilling of new mineralization targets at its Kombat Mine in Namibia (the “Project”) with key highlights from the drilling campaign. The reported results are from the East 400 area, 150 metres east of the Kavango Pit, discussed in recent press releases (August 4, September 15, and November 9, 2022 and January 21, 2023), the implications being a favourable confirmation of the Kombat trend mineralization.

Highlights of the Drill Results

Hole 4C (358 azimuth, -58 dip)

– 13m, 1.78%Cu, from 28m

Hole 4D (356 azimuth, -55 dip)

– 3m, 2.69%Cu, 28.7g/tAg, from 22m

Hole 5C (2 azimuth, -85 dip)

– 10m, 1.53%Cu, from 21m

Hole 6C (352 azimuth, -52 dip)

– 12m, 1.98%Cu, from 41m

The holes reported are from drilling testing gaps in the known mineralization previously thought to be barren. Holes 4C, 4D, 5C and 6C are verification holes testing continuity between areas previously drilled. The results are some of the longest intercepts drilled from surface and with both sulfide and oxide mineralization.

Jed Richardson, Trigon’s President and CEO, commented, “We are working towards a first blast in the open pit in April as planned. The team is now working on a detailed mine plan and the mine contractor is currently working on our tailings facility and they have all of the necessary equipment in place for start-up.”

The assays have been prepared and classified by Trigon Mining (Namibia)(Pty) Ltd in accordance with the reporting guidelines as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by the Canadian Securities Administrators.

Table of Drilling Highlights

|

Hole ID |

X |

Y |

Depth |

Azimuth |

Dip |

Significant and Selected Intersections |

Date of News Release |

|

CenMid01 |

74588.147 |

253430.329 |

36.20 |

350.1 |

-77.0 |

5.1m of 3.0% copper and 13.6 g/t silver, from 8.0m, 6.9m of 1.6% copper and 13.5g/t silver, from 16.1m. |

August 4, 2022 |

|

CenMid01A |

74759.065 |

253547.147 |

41.69 |

180.0 |

-76.8 |

11.0m of 2.6% copper, 75.0m down the hole |

August 4, 2022 |

|

CenMid02 |

74649.512 |

253475.398 |

58.08 |

201.6 |

-67.4 |

9.0m of 2.7% copper and 9.1 g/t silver, from 44.0m |

August 4, 2022 |

|

CenMid04 |

74679.864 |

253481.351 |

77.65 |

177.8 |

-61.7 |

6.0m of 2.4% copper and 5.6 g/t silver, from 55.0m 2m of 1.2% copper, from 67m. |

August 4, 2022 |

|

Infill05 |

74813.689 |

253508.664 |

76.00 |

186.6 |

-70.7 |

2m of 1.0% copper from 23.0m 4.0m of 0.8 copper from 28.0m 7.0m of 1.4% copper from 40.0m (see Figure 3) |

August 4, 2022 |

|

Infill06 |

74829.500 |

253512.902 |

79.15 |

181.0 |

-73.2 |

6.0m of 1.2% copper from 20.0m 10.0m of 1.7% copper from 56.0m |

August 4, 2022 |

|

E400-5B |

74965.000 |

253526.000 |

83.19 |

180.0 |

-50.0 |

4.0 m at 7.67 % copper and 10.73 g/t silver from 35.0m 3.0 m at 0.98 % Cu from 67.0 m. |

Sept 15, 2022 |

|

E400-07A |

74995.713 |

253539.191 |

88.23 |

180.0 |

-70.0 |

2.0 m at 1.19 % copper and 9.98g/t silver from 33.0m. |

Sept 15, 2022 |

|

E400-07B |

74994.991 |

253524.036 |

72.85 |

167.9 |

-49.0 |

4.0m of 2.25% copper and 5.49g/t silver from 30.0m 3.0m or 1.02 copper and 4.19g/t silver from 42.0m. |

Sept 15, 2022 |

|

E400-07C |

74995.000 |

253545.000 |

93.85 |

180.0 |

-55.0 |

6.0m of 1.02% copper and 10.42 g/t silver, from 50.0m |

Sept 15, 2022 |

|

CenEast 00 |

74752.736 |

253494.518 |

112.38 |

184.8 |

-71.1 |

19m at 1.18%, from 64-83m 3m at 3.24% copper and 11.75 g/t silver, from 101-104m |

November 9, 2022 |

|

Hole V01 |

74989.941 |

253533.340 |

78.30 |

172.7 |

-58.8 |

7m at 2.22% copper and 27.13 g/t silver, from 56-63m |

November 9, 2022 |

|

Hole V03 |

74974.992 |

253535.389 |

114.30 |

183.5 |

-53.3 |

47m at 1.20% copper and 5.35 g/t silver, from 28-75m |

November 9, 2022 |

|

E400-02A |

74917.375 |

253527.117 |

112.35 |

181 |

-71.8 |

8m, 1.10% Cu, from 94-102m |

January 19, 2023 |

|

E400-02B |

74917.444 |

253526.135 |

114.85 |

172.7 |

-58.8 |

9m at 0.9% copper 9-18m and 11m at 0.9% copper 68-79m |

January 19, 2023 |

|

E400-04A |

74949.328 |

253533.278 |

73.20 |

184 |

-43.2 |

5m at 3.98% copper and 8.7 g/t silver 44-49m |

January 19, 2023 |

|

E400-04B |

74950.352 |

253518.725 |

84.85 |

172 |

-49.4 |

17m at 1.0% copper and 15.50 g/t silver 0-17m |

January 19, 2023 |

|

E400-04C |

253,476 |

1,603 |

61.2 |

358 |

-58 |

13m, 1.78%Cu, from 28m |

February 22, 2023 |

|

E400-04D |

253,503 |

1,608 |

51.9 |

356 |

-55 |

3m, 2.69%Cu, 28.7g/tAg, from 22m |

February 22, 2023 |

|

E400-05C |

253,489 |

1,609 |

76.0 |

2 |

-85 |

10m, 1.53%Cu, from 21m |

February 22, 2023 |

|

E400-06C |

253,477 |

1,607 |

87.8 |

352 |

-52 |

12m, 1.98%Cu, from 41m |

February 22, 2023 |

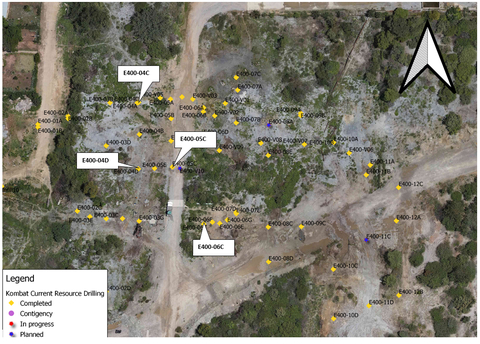

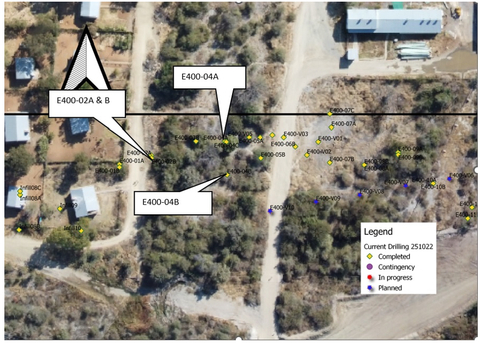

Figure 1: Map of the East 400 Program Area Showing Location of Holes 4C, 4D, 5C and 6C in East 400 Program Area Verification holes 4C, 4D, 5C and 6C are in the heart of the East 400 mineralized zone and should be considered infill holes confirming mineralization between holes previously drilled. The results reported here are notable because of the length of the intercepts above the projected reserve grade.

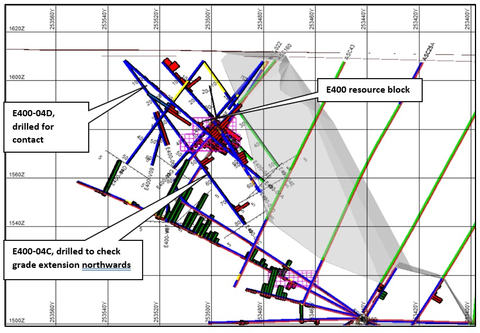

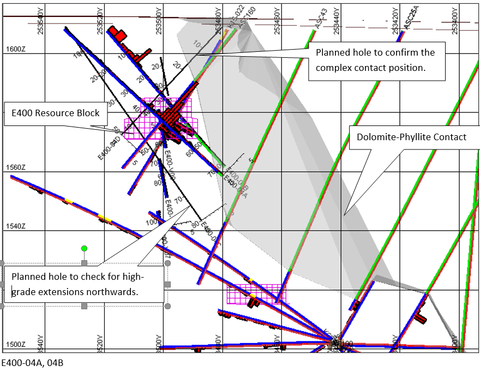

Figure 2: Cross Section E400 Hole 4C and 4D Figure 2 shows the draft resource modelling done before the drilling of E400-04C and E400-04D. Drilling the planned E400-04C checked for high-grade copper extension to the north, while the shallow E400-04D confirmed the position of the contact which is quite complex in this area.

Figure 3: Drill Core from Hole 4C The core pictured in Figure 3 shows the clearly visible sulfide mineralization.

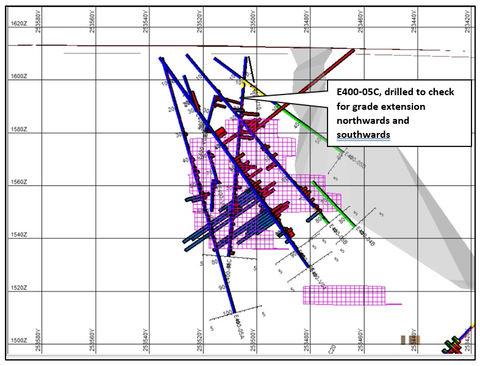

Figure 4: Cross section E400 Hole 5C Drilling E400-05C has confirmed the high-grade near-surface copper intersections suggested by historical drilling.

Figure 5: Drill Core from E400 Hole 5C The core pictured in Figure 5, again shows shiny golden-coloured chalcopyrite mineralization (copper mineral) throughout the drill core.

Figure 7: Drill Core from E400 Hole 6C The core pictured in Figure 7 again shows shiny golden-coloured chalcopyrite mineralization (copper mineral) throughout the drill core.

Quality Assurance & Quality Control (QA/QC):

All sample assay results have been monitored through the Company’s quality assurance / quality control (QA / QC) program following E2941 − 21 Standard Practices for Extraction of Elements from Ores and Related Metallurgical Materials by 4 acid Digestion with ICP-OES finish. Drill core was sent to an independent laboratory, African Laboratory Specialists Namibia (“ALS”), for analysis. ALS is an independent laboratory, located in Kombat, Namibia. Core samples were prepared using the ASTM procedures. Sample size: 3 kg, crushed split to 250g weighed sample (+/- 0.5000g).

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Renmark Financial to Host Virtual Non-Deal Roadshows this Week

Trigon will be participating in two live Virtual Non-Deal Roadshow sessions on Thursday, February 23, 2023. Trigon welcomes stakeholders, investors, and other individual followers to register and attend this live event.

The presentation will feature Jed Richardson, Chief Executive Officer and President and Aidan Sullivan, Vice-President, Investor Relations. Topics to be covered will include the latest investor presentation followed by a live Q&A. Investors interested in participating in this event will need to register using the links below. As a reminder, registration for the live event may be limited but access to the replay after the event will be on The Company’s Investor website.

Click a link below to register:

Thursday, February 23, 2023

10:00 a.m. ET: https://www.renmarkfinancial.com/live-registration/renmark-virtual-non-deal-roadshow-tsx-v-tm-otcqb-pntzf-2023-02-23-100000

4:00 p.m. ET: https://www.renmarkfinancial.com/live-registration/renmark-virtual-non-deal-roadshow-tsx-v-tm-otcqb-pntzf-2023-02-23-130000

Please access this link using the latest version of Google Chrome to ensure smooth connectivity.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Project, the mineralization of the Project, the Company’s exploration plans and results thereof, the prospectivity of the Project, the economic viability of the Project, the Company’s ability to restart operations and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

[embeddoc url=”https://www.trigonmetals.com/wp-content/uploads/TM-Kombat-Trend-Drilling-Final-Update-plus-Summary-February-2023-FINAL.pdf” download=”all” viewer=”google”]

by trigonmetals

TORONTO — Jan 30, 2023 — Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) to expand its land holding in Namibia, through the acquisition of exclusive prospecting licence 8529 (“EPL 8529” or the “Licence”). The Licence surrounds Trigon’s Kombat and Gross Otavi projects in the Otavi Mountainland, a region associated with high grade copper and silver mineralization.

EPL 8529 is situated on the Kombat trend, the mineralized structure on which the Kombat project is located, and covers an area of 5,614 hectares in the Grootfontein District of the Otjozondjupa Region, between the towns of Otavi to the west and Grootfontein to the east.

From a geological perspective, the Licence represents a potential strike extension of the Kombat project, with various known mineral occurrences on the property. Trigon management has extensive knowledge of the area and plans to implement an exploration program in conjunction with its ongoing exploration work on the Kombat project areas.

EPL 8529 is currently held by Namibian company, Otjiwa Mining and Prospecting CC (“Otjiwa”) and is valid for a period of three years from November 9, 2022 to November 8, 2025.

On January 30, 2023, Trigon, together with its Namibian subsidiary, Trigon Mining (Namibia) (Pty) Ltd (“Trigon Namibia”) entered into an agreement with Otjiwa for the acquisition of EPL 8529 (the “Agreement”). The purchase consideration for the Licence comprises a cash price of N$1,750,000 (approximately C$135,449) and N$250,000 (C$19,350) to be settled by the issuance of 84,129 Trigon shares.

The Agreement is subject to customary closing conditions, including approval from the Minister of Mines and Energy in Namibia for the transfer of the Licence from Otjiwa to Trigon Mining and the approval of the TSX Venture Exchange. The Acquisition is an arm’s length transaction.

Jed Richardson, President & CEO of Trigon Metals, commented, “EPL8529 referred to as the Copper King Extension, is an important part of the long-term future of the Kombat mine, the 35km of prospective strike length has numerous copper showings that Trigon is eager to test for potential economic deposits of mineralization, When surface drilling for near term open pit resources later this calendar year, drills will move to the new targets on the Copper King.”

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

CORRECTION NOTICE: Renmark Financial to provide Investor Relations Support and Host Virtual Roadshows

In a release issued on Tuesday, January 23 by Trigon Metals Inc. (TSXV:TM), please note that the paragraph under the subheading “Renmark Financial to provide Investor Relations Support and Host Virtual Roadshows” should have included the contract period during which IR services will be provided and the anticipated total costs of the activities. The corrected release follows:

The Company has engaged Renmark Financial Communications Inc. (“Renmark”) to amplify its investor relations efforts at an estimated total cost of $63,000 to the Company. The services will be utilized for a period of 7 months, having commenced on January 1, 2023 and ending on July 31, 2023, continuing monthly thereafter unless otherwise terminated pursuant to the terms set out in the agreement.

About Renmark Financial Communications Inc.

Founded in 1999, Renmark Financial Communications Inc. is North America’s leading retail investor relations firm. Employing a strategic and comprehensive mix of exposure tactics; Renmark hosts Virtual Non-Deal Roadshows as well as in-person corporate presentations and maintains daily communications with thousands of brokers and money managers across Canada and the United States. Renmark empowers its publicly-traded clientele to maximize their visibility within the financial community and strengthen its investor audience.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

This news release may contain forward-looking statements. These statements include statements regarding EPL 8529 and the Agreement, the Company’s ability to close the acquisition of EPL 8529, the prospectivity of EPL 8529, the planned exploration program for Kombat and EPL 8529, the Company’s strategies and the Company’s abilities to execute such strategies, the Company’s expectations for Kombat and EPL 8529, and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com

by trigonmetals

TORONTO — Jan 23, 2023 — Trigon Metals Inc. (TSX-V: TM; OTCQB: PNTZF) (“Trigon” or the “Company”) is pleased to provide an update on Company activities and share its plans for 2023. The Company anticipates a prompt reopening of the Kombat Mine, has begun trading on the OTCQB in the United States, and has engaged Renmark Financial to provide investor relations support.

Plans for Mine Re-Opening

Kombat Mine is projected to start up in calendar Q2/23 and Trigon has completed all drilling necessary for mine planning for the restart of the open pit. In addition, mine contractors have returned to the site at Kombat Mine and several new key geological personnel have joined the team.

In preparation for the commencement of underground mining in 2024, the Company has started work on sizing and picking underground equipment. Analysis of the flooded shaft is underway utilizing submersible cameras. We are pleased to report the shaft is in excellent condition and pumps are being ordered to commence drainage.

Namibia Geology Team

Trigon is pleased to welcome a talented team of mining professionals to Kombat Mine.

Juandre Farmer, Project Coordinator

Mr. Juandre Farmer is a Namibian citizen who recently graduated from the Namibian University of Science and Technology where he received his degree in Mechanical Engineering. He has gathered experience in the engineering industry during his practicum and we at Trigon Namibia looks forward to further enriching his experience. To date, he has gained a solid foundation in different skills and techniques that will be an asset for Trigon as a project coordinator.

Dag Kullman, Mining Manager

Mr Dag Kullmann is a Canadian mining engineer with 34 years experience in open pit and underground mining, including 10 years in consulting. His experience includes senior management and executive positions in gold, uranium and base metals companies as well as contract mining.

Augustinus Mungunda, Senior Resource Geologist

Mr. Augustinus Mungunda is a Namibian geologist with over 18 years of experience in base metal and uranium mining and exploration environments. His experience covers mining, exploration and resource evaluation. Augustinus holds an MSc (MRM) and is a member of SAIMM.

Hilaria Shatona, Senior Exploration Geologist

Mrs. Hilaria Shatona is a Namibian geologist with over 7 years experience in underground mining and exploration principally targeting base metal prospects. Hilaria Shatona holds a BSc degree in geology and physics and a certificate in project management.

Trigon Commences Trading on the OTCQB in the United States

The common shares of the Company Have begun trading on the OTCQB Venture Market (the “OTCQB”) in the United States under the stock symbol “PNTZF”, effective January 6, 2023.

The OTCQB is a U.S. trading platform that is operated by the OTC Markets Group in New York and is the premiere marketplace for early-stage and developing U.S. and international companies. Participating companies must be current in their reporting and undergo an annual verification and management certification process. The OTCQB Venture quality standards provide a strong baseline of transparency, as well as the technology and regulation to improve the information and trading experience for investors. Investors can find real-time quotes and market information for Trigon at https://www.otcmarkets.com/stock/PNTZF/overview.

Trigon has also received DTC eligibility by the Depository Trust Company (“DTC”) for its shares traded on the OTCQB.

The DTC is a subsidiary of the Depository Trust & Clearing Corporation and manages the electronic clearing and settlement of publicly traded companies. Securities that are eligible to be electronically cleared and settled through DTC are considered “DTC eligible.” This electronic method of clearing securities speeds up the receipt of stock and cash, and thus accelerates the settlement process for investors and brokers, enabling the stock to be traded over a much wider selection of brokerage firms by coming into compliance with their requirements. Being DTC eligible is expected to greatly simplify the process of trading and transferring the Company’s common shares on the OTCQB.

Renmark Financial to provide Investor Relations Support and Host Virtual Roadshows

The Company has engaged Renmark Financial Communications Inc. (“Renmark”) to amplify its investor relations efforts in 2023.

Trigon will be participating in Renmark’s live Virtual Non-Deal Roadshow Series to discuss its latest investor presentation on Thursday, January 26, 2023 at 2:00 PM EST. Trigon welcomes stakeholders, investors, and other individual followers to register and attend this live event.

The presentation will feature Jed Richardson, Chief Executive Officer & President and Aidan Sullivan, Vice-President, Investor Relations. Topics to be covered will include the latest investor presentation followed by a live Q&A. Investors interested in participating in this event will need to register using the link below. As a reminder, registration for the live event may be limited but access to the replay after the event will be on The Company’s Investor website.

Click the link below to register:

Thursday, January 26, 2023: https://www.renmarkfinancial.com/live-registration/renmark-virtual-non-deal-roadshow-tsx-v-tm-2023-01-26-140000

To ensure smooth connectivity, please access this link using the latest version of Google Chrome.

To ensure smooth connectivity, please access this link using the latest version of Google Chrome.

About Renmark Financial Communications Inc.

Founded in 1999, Renmark Financial Communications Inc. is North America’s leading retail investor relations firm. Employing a strategic and comprehensive mix of exposure tactics; Renmark hosts Virtual Non-Deal Roadshows as well as in-person corporate presentations and maintains daily communications with thousands of brokers and money managers across Canada and the United States. Renmark empowers its publicly-traded clientele to maximize their visibility within the financial community and strengthen their investor audience.

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Kombat Mine, the reopening of the Kombat Mine, the listing of the Company’s shares on the OTCQB, the engagement of Renmark Financial the economic viability of the Kombat Mine, the Company’s ability to restart operations and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

by trigonmetals

TORONTO — Jan 19, 2023 — Trigon Metals Inc. (TSX-V: TM; OTCQB: PNTZF) (“Trigon” or the “Company”) announces results from the drilling of new mineralization targets at its Kombat Mine in Namibia (the “Project”). These results are from the East 400 area, 150 metres east of the Kavango Pit, discussed in recent press releases (August 4, September 15, and November 9, 2022), extending the Kombat trend mineralization.

Highlights of the Drill Results

Hole 2A (181 azimuth, -71.8 dip)

– 8m at 1.10% copper 94-102m

Hole 2B (172.7 azimuth, -58.8 dip)

– 9m at 0.9% copper 9-18m and,

– 11m at 0.9% copper 68-79m

Hole 4A (184 azimuth, -43.2 dip)

– 5m at 3.98% copper and 8.7 g/t silver 44-49m

Hole 4B (172 azimuth, -49.4 dip)

– 17m at 1.0% copper and 15.50 g/t silver 0-17m

Figure 1: Map of the East 400 Program Area – The CenEast hole is east of the majority of the drilling that has been reported from this program in the area of the Kavango pit, initially disclosed in the press release dated May 17, 2022. It lies between East 200 affectionately called the Fat Avocado and what was previously thought to be a separate body situated to the east. (Photo: Business Wire)

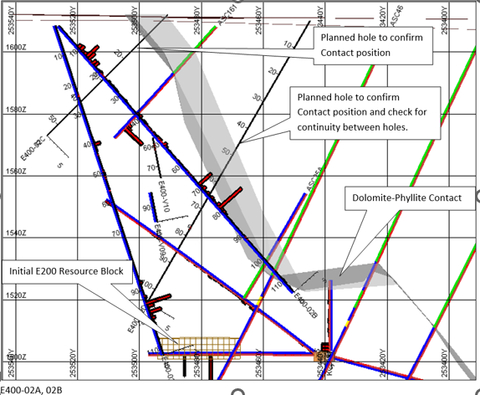

Figure 2: Cross Section E400 Hole 2A and 2B – The draft resource modelling done before the drilling of E400-02A & E400-02B could only show a very small resource block (yellow grid at the bottom of the section). By intersecting good Copper grades outside of the expected E200 Resource Block, there is a potentially significant increase in the E200 Resource Block tonnage and grade. Also, since there are good Copper intersections closer to surface, the Stripping Ratio of a potential open pit is expected to be improved. NOTE: Stripping Ratio = Ratio of Ore to Waste (Photo: Business Wire)

Figure 3: Drill Core from Hole 2A – The core pictured in Figure 3 shows the clearly visible sulfide mineralization. (Photo: Business Wire)

Figure 4: Location of Holes 2A, 2B, 4A and 4B in East 400 Program Area – Verification holes 2A, 2B, 4A and 4B are in the heart of the East 400 mineralized zone discussed in previous Trigon press releases and should be considered infill holes confirming mineralization between holes previously drilled. The results reported here are notable because of the length of the intercepts above the projected reserve grade. (Photo: Business Wire)

Figure 5: Cross section E400 Holes 4A and 4B – Drilling E400-04A has confirmed the high-grade near-surface Copper intersections suggested by historical drilling. In addition, E400-04B has also intersected high-grade copper on surface and just below which is expected to enhance the Stripping Ratio of a potential open pit. Drilling the planned E400-04C will check for high-grade copper extension to the north, while the planned shallow E400-04D will confirm the position of the contact which is quite complex in this area. (Photo: Business Wire)

Figure 6: Drill Core from E400 Hole 2B – The Core pictured in Figure 6, again shows shiny golden-coloured chalcopyrite mineralization (copper mineral) throughout the drill core. (Photo: Business Wire)

The holes reported are from drilling testing gaps in the known mineralization previously thought to be barren. Holes 2A, 2B, 4A and 4B are verification holes testing continuity between areas previously drilled. The results are some of the longest intercepts drilled from surface and with both sulfide and oxide mineralization.

Jed Richardson, Trigon’s President and CEO, commented, “Surface drilling continues for the Kombat open pit, we continue to be pleased with grades and the length of the intercepts in this area of our planned pit. We have completed all of the targeted holes for the mine plan for open pit restart scheduled to commence next quarter. We will announce the additional holes as those results become available. The final data is being collected and work has commenced on the mine plan, however, exploration drilling will continue as drills move to test new areas at surface.”

The assays have been prepared and classified by Trigon Mining (Namibia)(Pty) Ltd in accordance with the reporting guidelines as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by the Canadian Securities Administrators.

Quality Assurance & Quality Control (QA/QC):

All sample assay results have been monitored through the Company’s quality assurance / quality control (QA / QC) program following E2941 − 21 Standard Practices for Extraction of Elements from Ores and Related Metallurgical Materials by 4 acid Digestion with ICP-OES finish. Drill core was sent to an independent laboratory, African Laboratory Specialists Namibia (“ALS”), for analysis. ALS is an independent laboratory, located in Kombat, Namibia. Core samples were prepared using the ASTM procedures. Sample size: 3 kg, crushed split to 250g weighed sample (+/- 0.5000g).

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Project, the mineralization of the Project, the Company’s exploration plans and results thereof, the prospectivity of the Project, the economic viability of the Project, the Company’s ability to restart operations and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com

[embeddoc url=”https://www.trigonmetals.com/wp-content/uploads/Press-Release.pdf” viewer=”google”]

by trigonmetals

We’ve come to the end of 2022! It has been a big year for Trigon. In fact, the company is in a stronger position than ever.

We started this year announcing the first concentrates produced at the Kombat Mine in Namibia, after 14 years of closure. This is just one of Trigon’s achievements and milestones that would not be possible without your support.

In Morocco, we continued our exploration program identifying copper and silver grades with geophysics work and consolidated the land around our property to continue our drilling program.

As we plan for the New Year, we invite you to keep reading as we revisit some highlights of 2022 that stood out for Trigon Metals.

[button link=”http://bit.ly/3FLjC4H” bg_color=”#b8482c” window=”yes”]Year In Review 2022[/button]

Watch our last investor update video of the year with Trigon Metals’ CEO, Jed Richardson at Kombat Mine in Namibia.

by trigonmetals

TORONTO / Dec 14, 2022 – Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) announces that, further to its November 29, 2022 press release (the “Original Press Release”), the TSX Venture Exchange has approved the extension of the exercise period of a total of 11,649,996 share purchase warrants, all of which are exercisable at $0.20 per common share (collectively, the “Warrants”) by 12 months to January 8, 2024. The Warrants were issued pursuant to a private placement which closed on January 8, 2020. All other terms and conditions of the Warrants remain unchanged. The Original Press Release contained a clerical error stating that there were 4,983,330 Warrants outstanding however there are 11,649,996 Warrants outstanding.

A total of 6,666,666 Warrants are held by a party who is considered to be a “related party” of the Company. Therefore, the amendment of the term of the Warrants constitutes a “related party transaction” as contemplated by Multilateral Instrument 61-101 – Protection of Minority Shareholders in Special Transactions. However, the exemptions from formal valuation and minority approval requirements provided for by these guidelines have been relied upon as the fair market value of the Warrants held by related part does not exceed 25% of the market capitalization of the Company.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Warrants, the expected use of proceeds of the Warrants and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

by trigonmetals

TORONTO–Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) is pleased to report that the nominees listed in the management proxy circular dated November 8, 2022 for the annual and special meeting of shareholders of Trigon held on December 7, 2022 (the “Meeting”) were elected as directors of the Company. The appointment of each of the nominees to the Company’s board was approved by more than 96% of the votes cast at the Meeting. Shareholders at the Meeting also approved the appointment of the Company’s auditors, the Company’s stock option plan and the issuance of up to 2,500,000 common shares which could result in a new “Control Person”, as such term is defined in the policies of the TSX Venture Exchange.

Trigon management would like to thank shareholders for their participation and continuing support.

Trigon Metals Inc.

Trigon is a publicly-traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently, the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements under Canadian securities legislation. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “budget”, “forecast”, “schedule”, “continue”, “estimate”, ”expect”, “project”, “predict”, “potential”, “target”, “intend”, “believe” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are based on the opinions and estimates of management and certain qualified persons as of the date such statements are made. Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

For further information, contact:

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com