TORONTO — Trigon Metals Inc. (TSX-V: TM) (“Trigon” or the “Company”) announces results from drilling of new mineralization targets at Kombat Mine in Namibia (the “Project”), in the area of the Kavango Pit, along the Kombat trend mineralization.

Jed Richardson, President and CEO, commented, “Kavango drilling and the early mining in this area have been very encouraging. Mineralization has been far more consistent and massive, matching the nature of the mineralization we find in the underground mine and other areas of the Kombat trend. These initial results confirm our confidence that our revised exploration and production focus will provide significant upside.”

Highlights of the Drill Results

Holes from the Kavango Pit area:

Hole CenMid01 (azimuth 350.1, dip -77.0)

- 5.1m of 3.0% copper and 13.6 g/t silver, from 8.0m,

- And, 6.9m of 1.6% copper and 13.5g/t silver, from 16.1m.

Hole CenMid01A (azimuth 180.0, dip -76.8)

- 11.0m of 2.6% copper, 75.0m down the hole

Hole CenMid02 (azimuth 201.6, dip -67.4)

- 9.0m of 2.7% copper and 9.1 g/t silver, from 44.0m

Hole CenMid04 (azimuth 177.8, dip -61.7)

- 6.0m of 2.4% copper and 5.6 g/t silver, from 55.0m

- And, 2m of 1.2% copper, from 67m.

Holes from connecting the Kavango mineralization to the East 400 (Fat Avo) area:

Hole Infill05 (azimuth 186.6, dip -70.7)

- 2m of 1.0% copper from 23.0m

- And, 4.0m of 0.8 copper from 28.0m

- And 7.0m of 1.4% copper from 40.0m (see Figure 3)

Hole Infill06 (azimuth 181.0 , dip -73.2)

- 6.0m of 1.2% copper from 20.0m

- 10.0m of 1.7% copper from 56.0mHoles are following the mineralization from the area being mined eastward. Holes with the same number and a letter designation are drilled from the same location and different inclinations. Holes marked infill are holes drilled between the Kavango pit zone and the Fat Avo, a high-grade mineralized body previously identified by historic underground drilling. The drilling between the bodies is newly identified mineralization.

Holes are following the mineralization from the area being mined eastward. Holes with the same number and a letter designation are drilled from the same location and different inclinations. Holes marked infill are holes drilled between the Kavango pit zone and the Fat Avo, a high-grade mineralized body previously identified by historic underground drilling. The drilling between the bodies is newly identified mineralization.

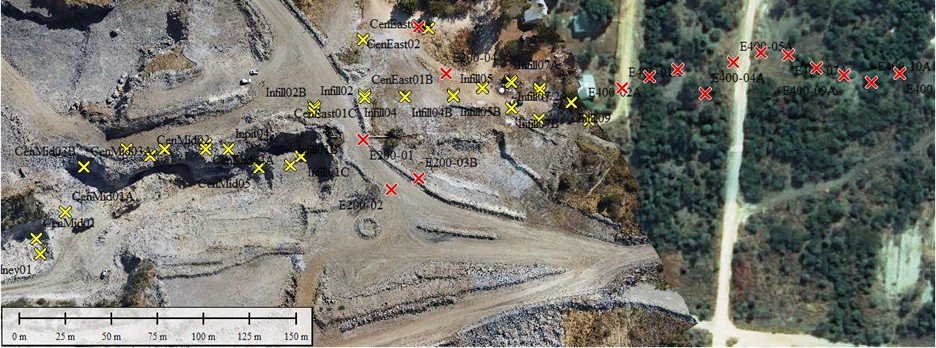

Figure 1: Map of Program Area

The aerial photo shows the area where mining and stripping have already occurred. A yellow “x” represents holes completed, both reported and those for which results are still pending and red “x” represents planned holes to be drilled.

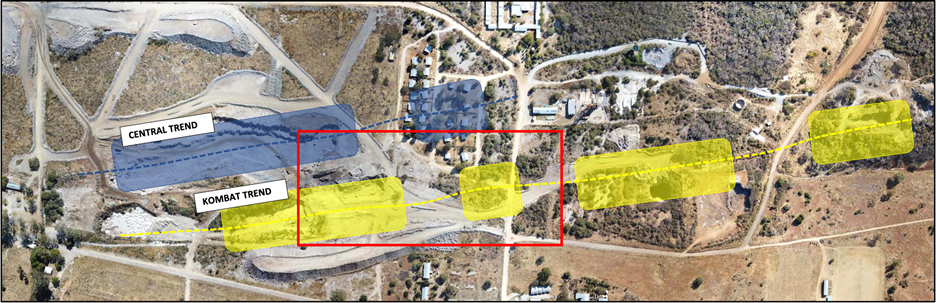

Figure 2: Open Pit Mining Area The red box is the zone depicted in the drilling map. See Figure 1

Figure 2: Open Pit Mining Area The red box is the zone depicted in the drilling map. See Figure 1

Figure 3: Drill Core from Hole Infill05 Core in the box is marked at the depth from surface versus the down-the-hole measurement in the numbers highlighted in the release.

Figure 3: Drill Core from Hole Infill05 Core in the box is marked at the depth from surface versus the down-the-hole measurement in the numbers highlighted in the release.

Qualified Person

The technical information presented in this press release has been reviewed and approved for disclosure by Fanie Müller, P.Eng, VP Operations of Trigon, who is a Qualified Person as defined by NI 43-101.

Trigon Metals Inc.

Trigon is a publicly traded Canadian exploration and development company with its core business focused on copper and silver holdings in mine-friendly African jurisdictions. Currently the company has operations in Namibia and Morocco. In Namibia, the Company holds an 80% interest in five mining licences in the Otavi Mountainlands, an area of Namibia widely recognized for its high-grade copper deposits, where the Company is focused on exploration and re-development of the previously producing Kombat Mine. In Morocco, the Company is the holder of the Silver Hill project, a highly prospective copper and silver exploration project.

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements include statements regarding the Project, the mineralization of the Project, the Company’s exploration plans, the prospectivity of the Project and the Company’s future plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statements or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Contacts

For further information, contact:

Jed Richardson

+1 647 276 6002

jed.richardson@trigonmetals.com

Website: www.trigonmetals.com